Not just the applicant but permanent residents also under spouse visa assessment

Q: I am a permanent resident running a business or self-employed. I am marrying a foreigner. What should I be cautious about when obtaining a spouse visa?

A: The spouse visa evaluation not only pertains to foreigners but also scrutinizes the income, taxes, and pension situation of the permanent resident becoming a spouse.

Not just the applicant but PR holder also under Spouse VISA assessment

When permanent resident entrepreneurs or self-employed individuals marry foreigners and apply for a spouse visa, the income (amount of executive compensation, personal income), tax, and pension payment situation on the side of the permanent resident also become subjects of the spouse visa evaluation.

For instance, if you are an entrepreneur who has set your executive compensation to zero or a very low amount, or a self-employed individual who declares a very low income amount (submitting the final tax return of personal business), there’s a possibility that approval may not be granted if a sufficient income to sustain the household cannot be recognized.

Necessary executive compensation and income

There isn’t a set amount for the necessary executive compensation, however, it is expected to be at a level that society deems sufficient for sustaining a household. Entrepreneurs who have set their executive compensation excessively low to reduce social insurance premiums and taxes will need to raise their executive compensation. Attention is also required regarding the tax treatment of executive compensation in this case (please consult your tax advisor if you are changing the amount of executive compensation during the business year).

Furthermore, for self-employed individuals, where “sales – expenses” equals “income,” caution is needed if a large amount of expenses is recorded, resulting in a small income amount. It will be necessary to clarify the current business performance, personal financial situation (savings and other financial assets, real estate, etc.) alongside.

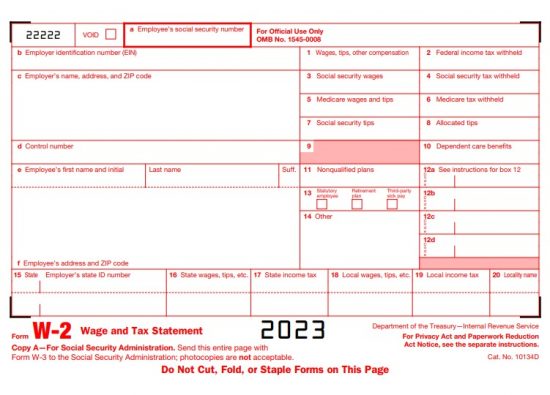

Tax and pension obligations

Additionally, in principle, you will need to submit documents such as a municipal tax payment certificate. If there are any unpaid amounts, the likelihood of approval may be low as the fulfillment of public obligations is not recognized. Therefore, it is crucial to pay all unpaid or overdue taxes before applying for a spouse visa. As of now, the spouse visa evaluation does not examine the enrollment in social insurance or the pension payment situation of the applicant’s spouse. However, during the permanent residency evaluation, the Japanese spouse’s tax payment and appropriate pension enrollment and payment situation are closely examined. Caution is advised if you wish to apply for permanent residency after obtaining a spouse visa.

Continental’s Services

When business owners or self-employed permanent residents apply for a spouse visa, unique issues pertaining to business owners and self-employed individuals arise. It is crucial to pay particular attention to providing rational explanations and clarifications in documentation and argument substantiation. At Continental, we will assess to your situation, explain the rational reasons to the Immigration Bureau, and conduct argument substantiation based on your individual situation. This reduces the risk of misunderstandings or misrecognition by the Immigration Bureau, significantly increasing the likelihood of spouse visa approval. If you have concerns, feel free to contact us.

(Recommended Reading) Obtaining a Spouse Visa

Professional

Masakazu Murai

Masakazu Murai

18 years’ experience in Investment Banking at Mitsubishi UFJ Morgan Stanley (JV, MUFG Bank and Morgan Stanley). He had provided financial advisory more than 500 entrepreneurs and senior management.

During his tenure, he worked as an employee union executive committee member in promoting diversity, including the active participation of foreigners and women in the office, and engaged in activities to improve the working environment. He specializes in financial consulting and VISA/PR consulting.

Gyoseishoshi Immigration Lawyer

CMA(Japanese financial analyst license)

CFP (Certified Financial Planner)

Master of Business Administration in Entrepreneurship