Housing Loans in Japan for Foreigners Without Permanent Residency: Requirements and Options

Foreigners’ Housing Loans in Japan

In Japan, most financial institutions such as banks often require foreigners to have permanent residency when applying for a housing loan. This is because foreigners who do not have permanent residency are generally granted a maximum stay of 5 years. If their residency status cannot be renewed or changed, they would have to leave Japan, increasing the risk for banks of not being able to recoup the money loaned (often for a long-term period of up to 35 years).

In Japan, most financial institutions such as banks often require foreigners to have permanent residency when applying for a housing loan. This is because foreigners who do not have permanent residency are generally granted a maximum stay of 5 years. If their residency status cannot be renewed or changed, they would have to leave Japan, increasing the risk for banks of not being able to recoup the money loaned (often for a long-term period of up to 35 years).

Banks Offering Housing Loans to Non-Permanent Residents

Few domestic banks, foreign banks, and non-banks in Japan handle housing loans for foreigners without permanent residency. Such loans often come with higher interest rates and stricter conditions regarding personal capital and repayment period compared to loans for Japanese citizens. Even major banks sometimes offer housing loans to foreigners on a limited basis, taking into account various factors such as workplace, income level, and degree of settlement in Japan.

Eligibility Criteria for Foreigners to Receive Housing Loan

Eligibility criteria for foreigners to receive housing loans in Japan may vary across financial institutions, but common requirements include having permanent residency, understanding Japanese language, being between 25 and 65 years old, being employed for 1-3 years or more, having a track record of 2-3 years as a company executive or sole proprietor, being able to join group credit life insurance, preparing a Japanese or permanent resident as a joint guarantor, having an annual household income of 4-6 million yen or more, and intending to live in the property with family.

Required Documents for Foreigners’ Housing Loan Application

Documents required for foreigners’ housing loan applications are generally the same as those for Japanese citizens. Any discrepancies or lack of documents can negatively impact the application, especially for foreigners who are not proficient in Japanese.

Measures When Foreigners Are Declined Housing Loans by Banks

If a foreigner without permanent residency is declined a housing loan by a bank, possible measures include acquiring permanent residency, applying for a loan in the name of a spouse or jointly with a spouse, and increasing personal funds or reducing the loan amount. Some banks may re-evaluate the application after a certain period (e.g., 6 months or 1 year), and it is crucial to confirm this with the bank’s representative.

Importance of Acquiring Permanent Residency Beyond Housing Loans

Acquiring permanent residency not only facilitates obtaining a housing loan from a financial institution, but also contributes to stable living in Japan. Particularly for those intending to purchase residential property and take out a long-term housing loan in Japan, it is recommended to consider obtaining permanent residency. It should be noted that acquiring permanent residency has become more stringent in recent years, requiring thorough preparation.

Early Acquisition of Permanent Residency

Foreigners wishing to obtain a housing loan in Japan may apply for permanent residency after 3 years of marriage and at least 1 year of residence in Japan if they are married to a Japanese citizen.

Also, foreigners working on a spouse or work visa may be eligible for permanent residency after only 1 year of residence in Japan if they are recognized as highly skilled professionals with 80 points +, based on their academic background, career history, annual income, and Japanese language proficiency.

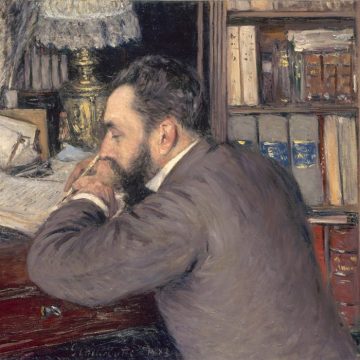

Professional

Masakazu Murai

Masakazu Murai

18 years’ experience in Investment Banking at Mitsubishi UFJ Morgan Stanley (JV, MUFG Bank and Morgan Stanley). He had provided financial advisory more than 500 entrepreneurs and senior management.

During his tenure, he worked as an employee union executive committee member in promoting diversity, including the active participation of foreigners and women in the office, and engaged in activities to improve the working environment. He specializes in financial consulting and VISA/PR consulting.

Gyoseishoshi Immigration Lawyer

CMA(Japanese financial analyst license)

CFP (Certified Financial Planner)

Master of Business Administration in Entrepreneurship