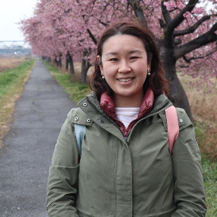

Self-Employed Foreign Nationals Applying for Permanent Residency in Japan

Guidance for Self-Employed Foreign Nationals

Applying for Permanent Residency in Japan

Understanding the Challenges for Self-Employed Applicants For foreign nationals who are self-employed and considering permanent residency in Japan, particularly those on a Spouse Visa (of Japanese or Permanent Resident), there are numerous factors to consider. Unlike salaried employees whose tax and pension contributions are managed by their employer, self-employed individuals handle their own tax returns and payments, including pension contributions. Common professions in this category include software engineers, investment bankers, lawyers, and doctors.

Rigorous Income and Compliance Assessment The Japanese Immigration Bureau stringently reviews the applicant’s (or their spouse’s, if self-employed) income magnitude, tax declarations, and pension payments. This scrutiny is markedly different from that for salaried employees in companies, where the employer ensures compliance with all procedures.

Key Points

- Whether the applicant or their spouse is self-employed.

- Compliance with tax and pension payments. These criteria apply equally whether it is the applicant or their spouse who is self-employed.

Learn more: Who is Scrutinized in Japan’s Permanent Residency?

Critical Aspects of Permanent Residency Application for Self-Employed

- Business Income Verification: Self-employed applicants must demonstrate sustained business performance for at least two fiscal years. The initial year of business is often considered unstable.

- Accurate Tax Reporting: All taxes must be calculated and declared correctly by the individual or their accountant. Any rectifications or penalties imposed by tax authorities can negatively impact the residency application.

- Timely Payment of Local Taxes: As self-employed individuals handle their own resident tax payments, timely payment within the designated periods is crucial. Delays or missed payments can lead to application denial.

- Social Insurance Compliance: Enrollment in national health insurance and pension schemes, and adherence to payment deadlines, are closely verified. Delays, even for a single day, can jeopardize the permanent residency application.

Support from Continental

Continental, with its team of experienced Certified Financial Planners (CFP) and Gyoseishoshi (administrative scriveners), offers expert advice on tax and pension matters critical to the permanent residency application process. Choosing to seek advice from a reputable East Coast firm like Continental can be a pivotal step in successfully navigating the complex landscape of permanent residency applications for self-employed foreign nationals in Japan.

This is aims to provide crucial insights for self-employed foreign nationals and their spouses seeking permanent residency in Japan. Understanding and meticulously adhering to the financial and legal requirements is essential for a successful application.