How Dependent Family Members Impact Your Permanent Residency Application in Japan

How Dependent Family Members Impact Your Permanent Residency Application in Japan

Does Having Dependent Family Members Negatively Affect My Permanent Residency Application?

Does Having Dependent Family Members Negatively Affect My Permanent Residency Application?

When applying for permanent residency in Japan, the number of dependent family members you support plays a significant role in the review process. The Japanese immigration authorities closely evaluate whether applicants have the financial resources required to support their family. This income requirement scales according to the size of your family to ensure you have a stable financial base for life in Japan.

Income Standards for Permanent Residency Applications and Dependent Family Members

The income requirements for a successful permanent residency application differ depending on your visa type and the number of family members you support. For instance, if you hold a working visa (such as “Engineer/Specialist in Humanities/International Services”), your income for the past five years will be reviewed, while for Highly Skilled Professionals (HSP), it varies from one to three years based on your points.

For example, an individual applying solo generally requires a minimum annual income of around 3 million yen. However, if they are supporting a spouse, the required income increases to approximately 3.8 million yen. With two children, this further rises to around 5.4 million yen. In other words, a higher income standard is necessary to prove you can reliably support a family while residing in Japan.

Legal Compliance: Proper Reporting for Tax and Social Security Laws

Japan’s tax system grants tax deductions (or “dependent exemptions”) for each family member listed as a dependent. Qualifying dependents include those within six degrees of kinship by blood or three degrees by marriage. However, to prevent misuse, 2016 regulations introduced strict requirements for proof, including documents verifying family relations (e.g., family registers or passports) and proof of financial support (e.g., remittance records). This prevents the abuse of Japan’s tax benefits through false claims and ensures compliance with tax and social security laws.

The immigration review process checks for accurate reporting to ensure you’re legally and financially compliant. If false dependents have been listed, immigration authorities may require applicants to revise past filings, potentially impacting your application outcome. Ensuring full transparency is crucial for a favorable evaluation.

Social Security and Recent Legal Revisions

Japan’s 2020 legal reform now limits social security benefits to dependents residing in Japan. This change ensures that healthcare and social benefits, including high-cost medical care or childbirth allowances, are only available to residents in Japan. Consequently, adding overseas dependents to social security has become highly restricted. For permanent residency applicants, this legal update underscores the need to clearly show that dependents included are indeed residing in Japan, in line with immigration standards.

Reviewing and Correcting Past Dependent Declarations

Before applying for permanent residency, review your past declarations regarding dependents to ensure compliance. If dependents were previously claimed for tax benefits without adequate support, the applicant may need to submit a correction to the local tax office or municipal office. Transparent and accurate reporting is essential, although a past correction doesn’t guarantee exemption from potential issues in the permanent residency evaluation.

Key Points for Permanent Residency Applications Involving Dependent Family Members

- Proof of Lawful Dependents: Applicants must demonstrate they’re lawfully supporting each dependent according to Japan’s legal requirements.

- Meeting the Income Threshold: Sufficient income based on family size is critical. A lower-than-required income can negatively affect your application for permanent residency.

Our office offers comprehensive support and expertise on permanent residency applications in Japan. Whether it’s ensuring that you meet income standards or that your dependent family members are accurately reported, we provide tailored guidance to increase your application’s success. If you have any questions, feel free to reach out for personalized consultation.

Professional

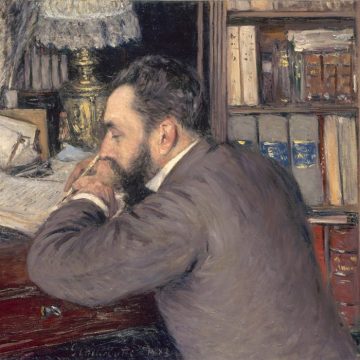

Masakazu Murai

Masakazu Murai

18 years experience in Investment Banking at Mitsubishi UFJ Morgan Stanley(JV, MUFG Bank and Morgan Stanley). He had provided financial advisory more than 500 entrepreneurs and senior management.

During his tenure, he worked as an employee union executive committee member in promoting diversity, including the active participation of foreigners and women in the office, and engaged in activities to improve the working environment. He specializes in financial consulting and VISA/PR consulting.

Gyoseishoshi Immigration Lawyer

CMA(Japanese financial analyst license)

CFP (Certified Financial Planner)

Master of Business Administration in Entrepreneurship