Permanent Residency for Foreign Business Owners

Foreign business owners who are managing companies under the status of a Japanese spouse, spouse of a permanent resident, or TEJYUSHA(定住者) can apply for permanent residency. Acquiring permanent residency provides stability and advantages when engaging in banking transactions, as it eliminates the time limit on their residence and enhances the stability of their business.

Foreign business owners who are managing companies under the status of a Japanese spouse, spouse of a permanent resident, or TEJYUSHA(定住者) can apply for permanent residency. Acquiring permanent residency provides stability and advantages when engaging in banking transactions, as it eliminates the time limit on their residence and enhances the stability of their business.

Key Points for Foreign Business Owners Applying for Permanent Residency:

1.Company Performance and Financial Status

- The performance and financial status of the company managed by the foreign business owner are thoroughly examined during the permanent residency application process.

- If the company’s financial condition is deemed unstable or if deliberate actions result in minor financial losses for tax-saving purposes, it may impact the approval of permanent residency.

2.Tax Compliance for both the Corporation and the Individual

- Unlike employees who have taxes deducted from their salaries, individual business owners must self-declare their income and expenses to the tax office, often with the assistance of a tax professional.

- In some cases, adjustments to the tax declaration may be required, and additional taxes, such as underreporting penalties or additional tax assessments, may be imposed. These circumstances can affect the permanent residency application process, as the immigration authorities review several years of tax compliance.

Learn more: Who is Scrutinized in Japan’s Permanent Residency?

3.Social Insurance Enrollment

- Companies, even with a single director (with no employees), have an obligation to enroll in social insurance. Foreign business owners applying for permanent residency must comply with this requirement. Compliance with social insurance premium payments and adherence to the payment deadlines are verified during the examination process.

It is essential to note that setting the director’s remuneration at an appropriate level, based on the ability to support dependents, is necessary. Attempts to reduce taxes by setting low director’s remuneration and covering living expenses through company expenses, such as housing and car costs, are not recognized for the purpose of permanent residency application. A certain minimum amount of director’s remuneration is mandatory.

In summary, when foreign business owners aim to acquire permanent residency, it is crucial to ensure the company’s performance and financial stability, comply with tax obligations, and fulfill social insurance requirements. Meeting these key points, along with satisfying other permanent residency application requirements, increases the chances of a successful application.

Learn more: If you and/or your spouse are self-employed?

Professional

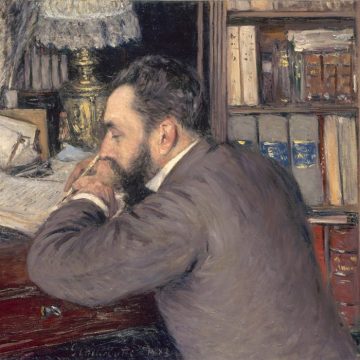

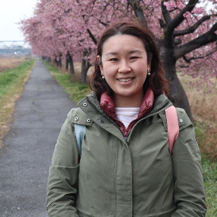

Masakazu Murai

Masakazu Murai

18 years’ experience in Investment Banking at Mitsubishi UFJ Morgan Stanley (JV, MUFG Bank and Morgan Stanley). He had provided financial advisory more than 500 entrepreneurs and senior management.

During his tenure, he worked as an employee union executive committee member in promoting diversity, including the active participation of foreigners and women in the office, and engaged in activities to improve the working environment. He specializes in financial consulting and VISA/PR consulting.

Gyoseishoshi Immigration Lawyer

CMA(Japanese financial analyst license)

CFP (Certified Financial Planner)

Master of Business Administration in Entrepreneurship

相談してみる