Permanent Residency from Business Manager Status

Can I Apply for Permanent Residency from a Business Manager or Highly Skilled Professional (i)(c) Status?

Can I Apply for Permanent Residency from a Business Manager or Highly Skilled Professional (i)(c) Status?

For foreign business owners, Japan’s immigration office will evaluate the company’s financial performance, tax and pension compliance, and overseas travel history during the permanent residency review process.

For foreign business owners, Japan’s immigration office will evaluate the company’s financial performance, tax and pension compliance, and overseas travel history during the permanent residency review process.

Permanent Residency

from Business Manager Status

The Business Manager visa has a maximum duration of five years. When seeking loans from financial institutions, the limited nature of this visa can be seen as a risk factor, making long-term loans (such as over five years) difficult. Lenders are concerned about repayment should the visa holder lose status and leave Japan.

However, once permanent residency is granted, there are no limitations on the period of stay, which improves the individual’s stability in Japan and may lead to more favorable treatment from banks.

Furthermore, permanent residency allows dependents—such as spouses and children born in Japan—to enjoy more flexible visa statuses, such as “Spouse or Child of Permanent Resident,” with no restrictions on employment or part-time work. The permanent resident can also retire and remain in Japan indefinitely.

Key Requirements When Applying for PR from Business Manager Status

- Applicants must pay close attention to the financial performance of their company, the amount of executive compensation, and their record of tax and social insurance payments.

- At the time of application, the applicant must hold a 3-year or 5-year visa. Additionally, the company must have a positive retained earnings balance. If the business performs well, a 3- or 5-year visa may be granted within two to three years of initially obtaining the Business Manager status. Applicants who qualify for Highly Skilled Professional (i)(c) or J-SKIP should consider applying, as these statuses offer a 5-year visa from the outset and facilitate faster PR eligibility.

- The screening period for permanent residency generally takes over one year. If your current visa has less than one year remaining at the time of application, you may need to renew it while your PR application is pending.

PR Requirements from Business Manager Status

| 1. Good Conduct Requirement |

|

|---|---|

| 2. Financial Stability Requirement |

|

| 3. National Interest Requirement |

|

| 4. Guarantor Requirement |

|

Notes on Executive Compensation

Many company founders initially set low executive salaries (e.g., JPY 200,000/month) to reduce tax and social insurance burdens. However, low salaries may cause PR applications to be rejected due to insufficient household income. As a general rule, the minimum income threshold is JPY 3–3.6 million per year for the applicant, plus approximately JPY 800,000 per dependent. The last five years of executive income should meet or exceed this threshold.

For HSP and J-SKIP holders, company profitability must also support the consistent payment of high compensation. Even if personal living costs are supplemented by corporate-paid housing, meals, or transportation, authorities will evaluate the stated salary level.

Tax Filing and Payment

Both corporate and individual taxes must be properly filed and paid on time. Late payments or amended tax returns following audits may count as negative factors during PR screening. In cases of tax fraud or criminal violations of the Income Tax Act or Consumption Tax Act, not only will PR be denied, but current visa statuses may be revoked.

Applicants with criminal penalties (e.g., imprisonment or probation) must wait 5–10 years after completing their sentence or probation before becoming eligible for PR.

Social Insurance Compliance

Both the company and the applicant must be properly enrolled in Japan’s social insurance system. Even single-person corporations are required by law to participate. This also extends to employees. Labor compliance practices are often examined during PR review, especially for companies employing foreign staff.

Company Financial Performance

At least two consecutive years of black-ink operations are typically required. Companies with negative net assets or deficits in retained earnings may be disqualified. Some entrepreneurs under-report income for tax benefits, but this may negatively impact their PR application.

For HSP (i)(c) and J-SKIP holders, high executive salaries require substantiating business results. Be prepared to submit multi-year financial statements. Consultation with a professional is strongly recommended.

Watch: Permanent Residency from Business Manager Visa (YouTube)

About the Author

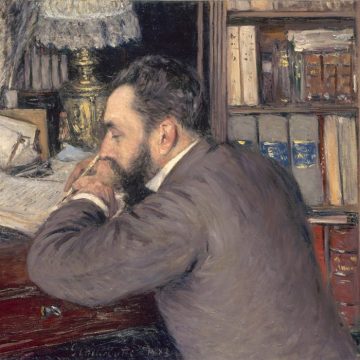

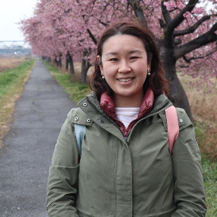

Masakazu Murai

Masakazu Murai

Born in 1977. Former investment banker at Mitsubishi UFJ Morgan Stanley, a joint venture between MUFG and Morgan Stanley, with 18 years of experience in capital markets and M&A advisory. Provided strategic and financial advice to over 500 startup founders and publicly listed executives during his career.

Currently specializes in Japanese immigration and permanent residency procedures for foreign business owners. His hobbies include attending Japanese idol concerts, watching Leonardo DiCaprio films, and spending time with his cat.

Certified Administrative Scrivener (authorized immigration proxy), Certified Financial Planner (CFP), and Chartered Member of the Securities Analysts Association of Japan.