Side Jobs and Additional Income for Foreign Employees in Japan

Additional Income for Foreign Employees:

An increasing number of foreign employees in Japan have side jobs and additional income, such as freelance translation/interpretation, rental property income, or earnings from monetized YouTube channels.

If they have a certain amount of income (revenue-expenses) outside of their regular salary, they need to check if they are required to file a tax return. However, regardless of the income amount, those with side jobs or additional income generally need to file a resident tax declaration with their local government.

Consult with a tax expert or tax office for proper income classification (business or miscellaneous income) and payment methods. Be aware that failure to declare income can result in penalties, affect visa renewals, and impact permanent residency or naturalization applications.

Side Jobs and Additional Income Requiring Tax Returns:

- Part-time work at restaurants (annual income over 200,000 yen)

- Freelance writing, translation, or interpretation fees (“)

- Online business and peer-to-peer transactions (“)

- Monetized YouTube earnings (“)

- Income from cryptocurrency sales (“)

- Income from rental properties (“)

Visa Restrictions:

Foreign residents in Japan can only engage in activities allowed by their visa status. For example, those with a technical, humanities, or international business visa cannot work part-time at restaurants or for Uber Eats. Unrestricted activities are limited to those with visas such as “Spouse of a Japanese National.” If engaging in activities outside their visa status, they must obtain permission for activities outside their status.

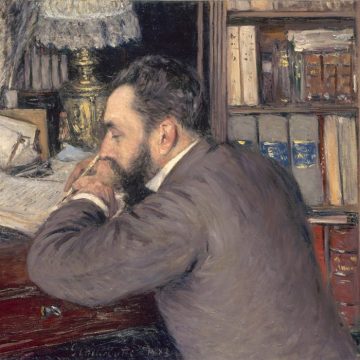

Professional

Masakazu Murai

Masakazu Murai

18 years’ experience in Investment Banking at Mitsubishi UFJ Morgan Stanley (JV, MUFG Bank and Morgan Stanley). He had provided financial advisory more than 500 entrepreneurs and senior management.

During his tenure, he worked as an employee union executive committee member in promoting diversity, including the active participation of foreigners and women in the office, and engaged in activities to improve the working environment. He specializes in financial consulting and VISA/PR consulting.

Gyoseishoshi Immigration Lawyer

CMA(Japanese financial analyst license)

CFP (Certified Financial Planner)

Master of Business Administration in Entrepreneurship

相談してみる