Key points:Transferring capital from foreign countries

What are the cautionary points for transferring capital from foreign countries shen setting up a company.

What are the cautionary points for transferring capital from foreign countries shen setting up a company.

Varid Japanese bank accounts (personal) is needed to transfer the capital to the new company.

Varid Japanese bank accounts (personal) is needed to transfer the capital to the new company.

Need personal bank account in Japan to transfer capital

(A bank account that can be used to transfer capital)

In order to set up a company, it is necessary to transfer capital to a Japanese bank account. If you do not have a bank account in Japan, you can not set up a company. There was no problem if you had a bank account in Japan because you used to study in Japan. Also, if you have a personal account such as a Tokyo branch of a foreign bank (ex. Tokyo branch, Bank of China), you may be able to use that account.

②Branches of foreign banks in Japan

(Name of bank account)

The names of bank accounts that can be used to transfer capital are 1) Incorporators(発起人), 2)Directors(取締役), 3) other third parties (Special occasion). If you transfer capital to a bank account other than the Incorporator, you need a power of attorney for receipt of capital from the Incorporator to the account holder.

See the Japanese Government website

②Directors

③Third parties (such as relatives and acquaintances living in Japan)

Remittance takes longer than domestic remittance

Depending on the country or bank, it may take some time to receive capital money from your home country. Therefore, you need to check with your bank about the remittance schedule.

By the way, it is better to think that some foreign banks are not familiar with remittance to Japan.

Remittance fee & Exchange rate

As foreign money transfer charges will be applied to foreign exchange and remittance, if the amount of capital is 5 million yen, the fee will be deducted and the deposit will be less than 5 million yen. Even if the amount less than 5 million yen, such as 4,990,000 yen, is transferred, it does not mean that the capital has been fully invested.

In addition, if it is converted to Japanese yen due to the fluctuation of exchange rate, it will fall below the required amount of capital (for example 5 million yen), so it must be always converted to 5 million yen or more converted to Japanese yen.

On the contrary, it is OK that the amount of money than the capital is transferred. It is safer to transfer exchange rates and fees, and to transfer a little more.

Foreign currency remittance restrictions

For example, as in China, there may be foreign currency remittance restrictions (up to $ 50,000 a year). Also, depending on the amount of money, it may be necessary or necessary to obtain the permission of the bank or government. If you can not remit the amount you need at one time, in China, you may be asked to remit the amount you need from another family member or relative.

How to get a Business Manager VISA

Professional

Masakazu Murai

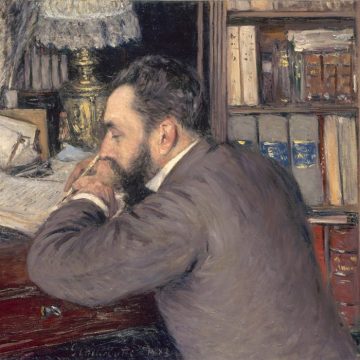

(Photo: He was an investment banker, 20s…… )

Immigration consultant, Financial advisor

He has 18 years experience in Investment Banking at Mitsubishi UFJ Morgan Stanley. He had provided financial advisory more than 500 entrepreneurs and senior management.

He currently supports many foreign entrepreneurs in Japan, taking advantage of the experience of an investment banker. He is the best expert of Business VISA in Japan.

Gyoseishoshi Immigration Lawyer

CMA(Japanese financial analyst license)

CFP (Certified Financial Planner)

MBA in Entrepreneurship(Hosei Business School)