Business Manager VISA → Permanent residence in Japan

Getting a Permanent Residence from a Business Manager Visa

Advantages of “getting permanent residence” from business manager visa

Business Manager visas have a maximum stay of 5 years. Therefore, when borrowing business funds from a bank, the stability of residence is considered to be lacking, and it is not possible to borrow a sufficient amount of money or it is difficult to set a long-term repayment date. However, by acquiring permanent residence, the period of residence becomes indefinite, and it works for banking transactions as stability of the period of residence is improved.

In addition, the permanent resident’s spouse and the permanent resident’s child’s residence status become “the permanent resident’s spouse, etc.”, so there are no restrictions on working and part-time jobs, and the freedom of activities in Japan will be improved.

Requirements for Permanent Resident from Business Visas

When aiming to obtain permanent residence from a business management visa, the Immigration Bureau reviews the company’s business performance, tax obligations, social insurance obligations, etc.

In practice, it is possible to apply for permanent residence within a minimum of 2-3 years from acquisition of a management visa (as long as the period of residence is 3 years) on the premise that the requirements for permanent residence other than the above are met.

The examination period may take 6 to 10 months, so it may be necessary to renew your current status of residence during the application.

Requirements for Permanent residence

| ① The person is of good conduct. |

The person observes Japanese laws and his/her daily living as a resident does not invite any social criticism.

|

|---|---|

| ② The person has sufficient assets or ability to make an independent living. |

- 2 years experience from starting a business

(It is a surplus settlement) - If the company’s performance is continuously in the red or in debt, it is not acceptable. - Executive compensation is at least 3 million yen or more (for the past 3 years) - Necessary income will be added 700,000 yen for each additional dependent. |

| ③ The person’s permanent residence is regarded to be in accord with the interests of Japan. |

1.In principle, the person has stayed in Japan for more than 10 years consecutively. It is also required that during his/her stay in Japan the person has had work permit or the status of residence for more than 5 years consecutively. - Conducting activities in accordance with the status of residence of Business manager VISA

- That there are no more than 100 days of departure a year or more than three months a year 2.The person has been never sentenced to a fine or imprisonment. The person fulfills public duties such as tax payment. -Corporate and individual tax liability(No payment delay)

-Social Insurance Obligation 3.The maximum period of stay allowed for the person with his/her current status of residence 4.There is no possibility that the person could do harm from the viewpoint of protection of public health. |

| ④Having a guarantor |

Contents of guarantee of guarantor

– Accommodation expenses, return expenses, legal compliance – Economic liability not included – It is morally responsible, not legally responsible |

Attention: Social insurance payments

In the future, if you wish to change from a business management visa to permanent residence, it is essential to fulfill your tax payment and social insurance obligations. In the Permanent Residence Examination, the Immigration Bureau examines not only whether payment is being made, but also the payment deadline. Payment is confirmed for at least one year from the application.

There are many businesses that do not subscribe to social insurance as small businesses, but legally, corporations are obliged to subscribe to social insurance.

Even if you later subscribe to social insurance and pay the premium, you may not be granted permanent residence as you do not keep the deadline.

If you want to obtain permanent residence, you should debit the account so that you do not forget to pay the social security fee.

Our Professional

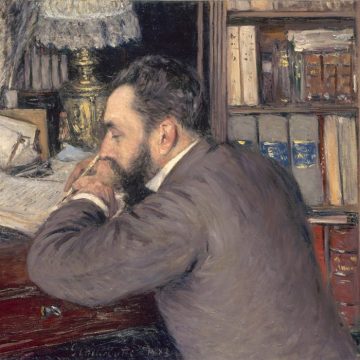

Masakazu Murai

Masakazu Murai

Immigration consultant, Financial advisor

He has 18 years experience in Investment Banking at Mitsubishi UFJ Morgan Stanley. He had provided financial advisory more than 500 entrepreneurs and senior management.

He currently supports many foreign entrepreneurs in Japan, taking advantage of the experience of an investment banker. He is the best expert of Business VISA in Japan.

Gyoseishoshi Immigration Lawyer

CMA(Japanese financial analyst license)

CFP (Certified Financial Planner)

MBA in Entrepreneurship(Hosei Business School)